Hello, my name is Robert Kavon, and I'm an attorney at Taxes Professionals. I handle financial analysis for offer and compromise, which essentially determines if you qualify and how we can legally tweak it to make you qualify. In this guide, we will be covering New York offer and compromise. We have written a guide that explains how to do it yourself or for our clients who want us to do it. It gives them an explanation of how the process works. There are two main forms that almost everybody will need to fill out - DTF 4.1 and DTF 5. DTF 4 is for liabilities that are not fixed and final or for doubt as to liability offer and compromise. Most people will have liability that is fixed and final, so they already know what it is and will use DTF 4.1 and DTF 5. Let's go through DTF 4.1 first. This form is where you state what you are offering and provide your basic information. The assessment ID is not that important, but if you have it, include it. If you don't have this information, call the state and they will give you all the liabilities owed. If there is additional information, you may need to add another page by including a little text. On this additional page, you can include the facts supporting your offer and why you should qualify. Finally, the signatures are required on this page. Now let's move on to DTF 5, which is the financial statement. This form is a statement of financial condition and other information. They are looking to see if you have more assets than the tax balance or if you have a significant amount of money left over at the end of the month. Either of these situations will likely disqualify you...

Award-winning PDF software

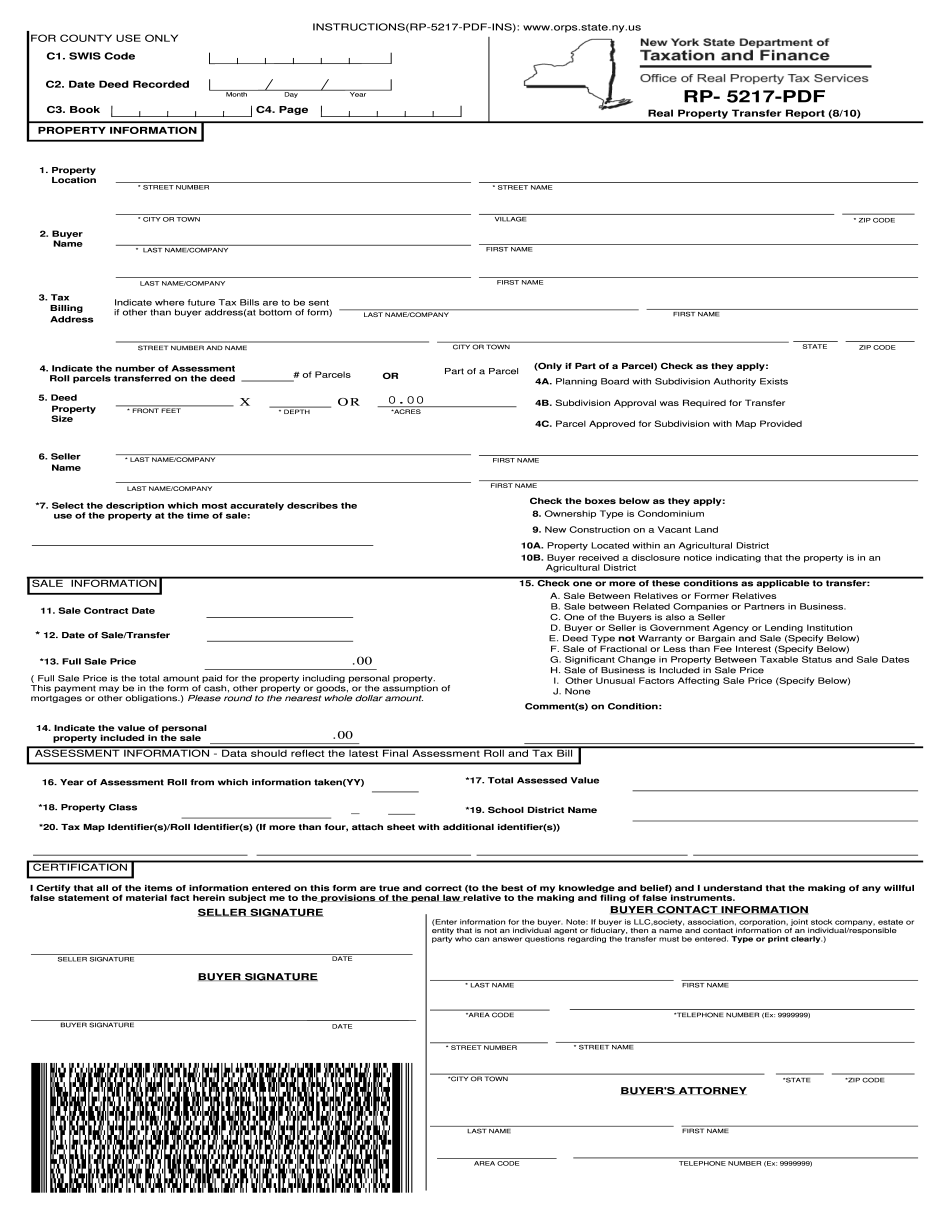

NY DTF RP-5217-PDF Form: What You Should Know

In New York State, a land trust of at least 500,000 can be used as the legal owner of real property. To be eligible for transfer of a piece of real property, the legal title must be transferred to the land trust. If a property transfer is not completed within 60 days after the property is transferred, any tax liability for that property is waived. This form is not used as a sales tax record; it is a report prepared for the transfer of any property. RP-5217-NYCRM requires the following information: If you are filing within 30 days of the property transfer and there were tax and interest payments made from the date of the property transfer, be sure to have the seller complete a property tax release form. If you are filing after the 30-Day Deadline but after the first year, you are required to submit the following: The original record and notice and statement of sale with an acknowledgment of taxes paid or receivable from the date of the property transfer. This acknowledgment of tax payment or receivable must be in the same form as the Record and Notice, and must contain each of the following items: The original purchase price, which can be filed together with the transfer application. The tax paid from date of the initial inspection. The tax amount and paid or payable date. The original deed to the property, which can be filed together with the transfer application. When the property transfer is complete and the seller accepts the transfer, a second signature is required of the buyer. The seller must sign the second signature and the buyer must sign the second signature. Once both signatures are submitted, a copy of each document must be submitted. An acknowledgment is not required of the property owner, but if the property owner has been given a copy of the Record and Notice, which is shown as Exhibit RP-5217-NYC, the copy of the Record and Notice is signed by the buyer, and the seller acknowledges the fact that the property was transferred in the prescribed manner. An acknowledgment of payment or receivable is not required of the buyer of real property. The signature of the buyer must complete the form and the seller must sign the form. The seller is required to sign the form. The signature of the buyer of real property must be accompanied by a notarized copy of the tax or other document with which the seller asserts tax liability. The seller must sign the copy of the tax document with the original of the tax document showing the amount paid.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do NY DTF RP-5217-PDF, steer clear of blunders along with furnish it in a timely manner:

How to complete any NY DTF RP-5217-PDF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your NY DTF RP-5217-PDF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your NY DTF RP-5217-PDF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing NY DTF RP-5217-PDF